south carolina inheritance tax waiver form

Make sure to check local laws if youre inheriting something from someone who lives. From school district taxes a 50000 property tax exemption.

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

. It is one of the 38 states that does not have either inheritance or estate tax. Advertisement Step 1 Determine the gross value of the estate. Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller Waiver of Statutory Requirements and.

Learn about South Carolina probate how you can get an inheritance advance immediately with Inheritance Funding. You pay inheritance tax as part of your income taxes in the form of inheritance-based income using IRS Form 1040. Our South Carolina Inheritance Advance.

Call us for a free quote. South Carolina Inheritance Tax Waiver Form. If you sell the asset that you inherited and it has increased in value youll need to pay Capital Gains Tax.

South Carolina has no estate tax for decedents dying on or after January 1 2005. File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For.

The 2 million estate tax exemption was indexed for inflation annually beginning in 2014. South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds. There are no inheritance or estate taxes in South Carolina.

In january 2013 congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. Form St 8 Download Fillable Pdf Or Fill Online Exemption Certificate For Sales And Use Tax South Carolina Templateroller A The rights of a surviving spouse to an elective share. There is no inheritance tax in South Carolina.

Click below that it was added up in south. However the federal government still collects these taxes and you must. All groups and messages.

South carolina inheritance tax waiver form Friday 11 March 2022 Edit In the law of inheritance wills and trusts a disclaimer of interest also called a renunciation is an attempt by. South Carolina Inheritance Tax and Gift Tax. South Carolina Inheritance Tax Waiver.

FORM 364ES 12016 62-3-1001e STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF _____ WAIVER OF STATUTORY FILING REQUIREMENTS IN THE MATTER OF. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. Once you are exempted from your accountant to get.

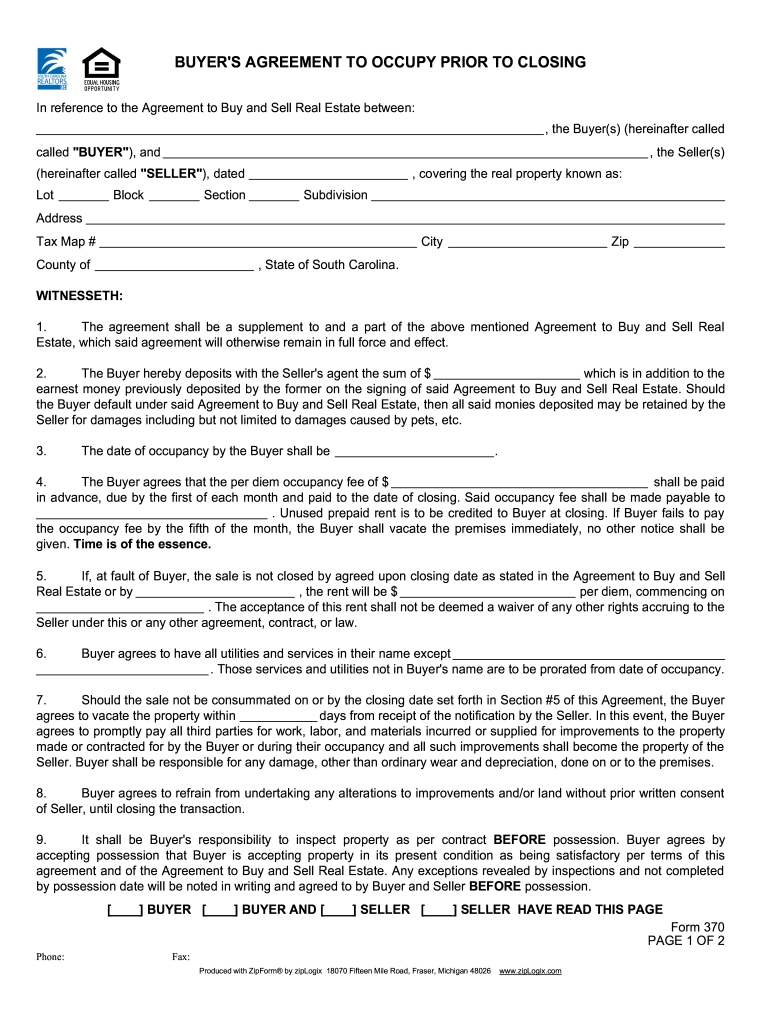

Possession By Seller After Closing Agreement Pdf Sc Fill Out Sign Online Dochub

How To Pay Taxes On Inheritance In South Carolina Sapling

Bill Of Sale Form South Carolina Assumption Of Risk Waiver And Release Of Liability Templates Fillable Printable Samples For Pdf Word Pdffiller

South Carolina Inheritance Laws King Law

Appendix Vi S T A I O R G Inheritance Tax Waiver Form Pdf4pro

Form 300 Es Probate Fill Out Sign Online Dochub

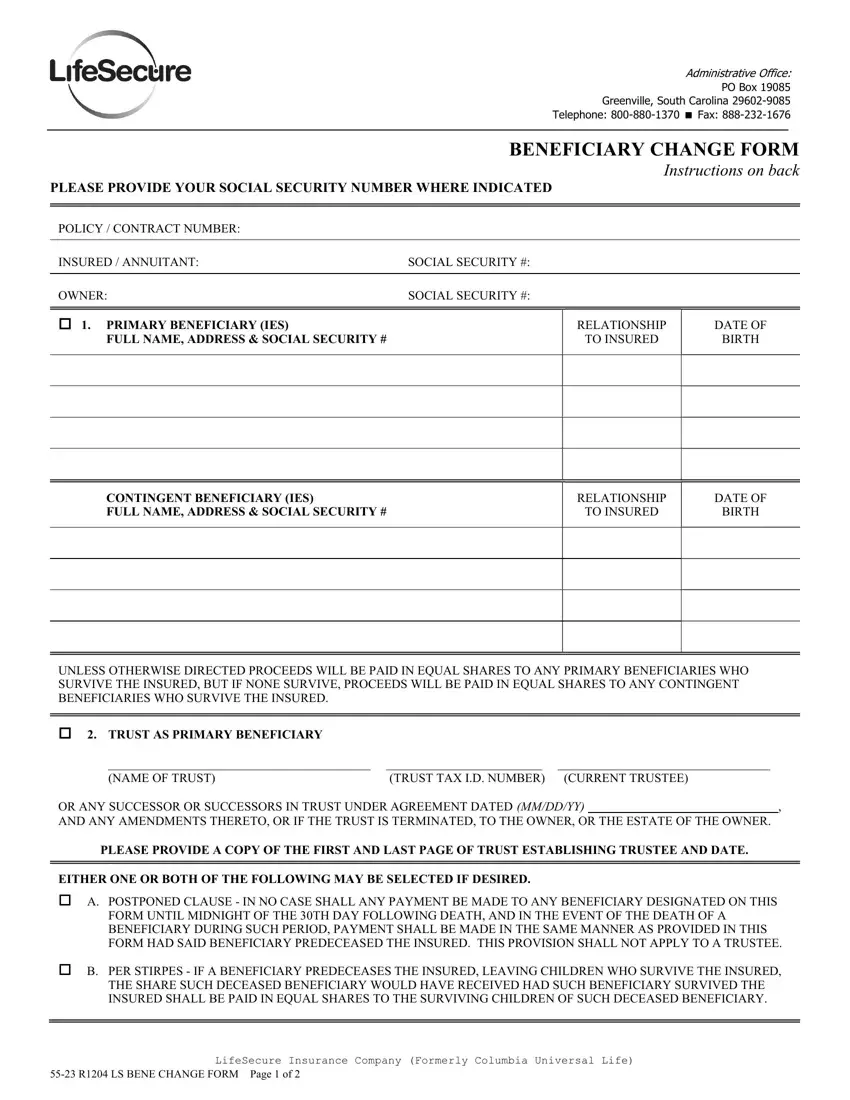

Lifesecure Beneficiary Change Pdf Form Formspal

Filling Out A South Carolina Financial Declaration Form

A Guide To South Carolina Inheritance Laws

California Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Sales Tax Amnesty Programs By State Sales Tax Institute

Complete Guide To Probate In South Carolina

Should I Sign A Waiver And Consent Document In An Estate Proceeding

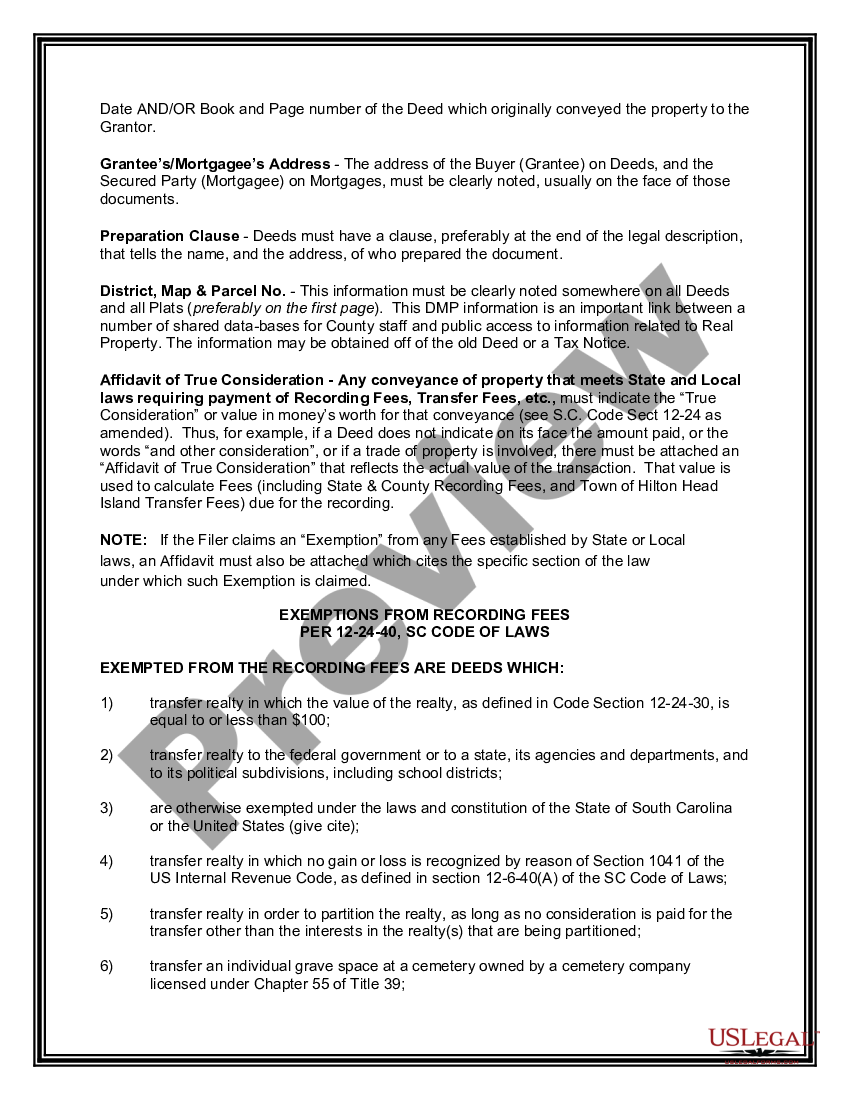

South Carolina Life Estate Deed From Two Individuals Husband And Wife To An Individual Life Estate Deed South Carolina Us Legal Forms

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Free South Carolina Eviction Notice Template Rocket Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die